Anthropological Reflections on the Monetary System

The end-of-year article by Mosadoluwa Fasasi is followed by an extensive collection of quotes to help us think about the multiple aspects of money and value, and how to transform them.

Introduction by Michel Bauwens

First of all, I’d like to thank all my readers and in particular the paying readers who have made this writing project possible. Merry Xmas and a Happy New Year to all. This edition is an invitation to all of us to think about what we truly value in the world, and in particular, to think about the function of money, and whether we could function as a complex society without it.

On November 8, we published a thought piece on monetary reform by Michel Foata-Prestavoine, which turned out to be exceptionally popular, soliciting many reactions which we published as comments. But a previous guest author from DeSci Nigeria, Mosadoluwa Fasasi, has proposed a full article of further reflection, which we reproduce here below.

We also add a second and third part, with quotes that can help us think in new ways about value, accounting for value, and the role of money specifically. This is the result of collating material about monetary issues since 2005, so I hope you appreciate the long period of selection that preceded it. I recommend reading a quote or two per day during the next two weeks, to set in motion a more profound meditation on the nature of value, and its expression through monetary means.

For every quote, the source link is added, which was correct at the time of collection. All the quotes are still available via the wiki of the P2P Foundation.

Part I: Anthropological Reflections on the Monetary System

By Mosadoluwa Fasasi .

“The guest editorial, “Money: Black Magic, White Magic, A Chronicle” by Michel Foata-Prestavoine, approaches money foundationally. It is unsurprising that it left me with foundational questions about money, questions we will get to in a bit. The focal argument of the editorial is that the root problem with money isn’t just usury (interest), scarcity, or profit, but rather, the transactional symmetry in monetary systems. This symmetry means, every monetary exchange is a zero-sum (what one gains, another loses) and accounts only for private value, ignoring impacts on our shared commons.

He further argues that this transaction symmetry dates back to the Neolithic era. A time when human societies shifted from hunter-gathering to settled agriculture, which led to the beginnings of organized exchange and the use of proto-money such as shells, beads, or other collectible objects that held value within small communities. During that era, exchanges were personal and the impact on the commons was limited and almost invisible. If at all it was visible, it would be easily called-out among the commons. The world has evolved into more complex societies, yet, we operate on the same monetary system, with more impact on the commons but less calling-out; or perhaps, the system has become so monstrous that the calling-out hitherto has not been able to yield much result.

Michel Foata-Prestavoine’s proposition is to create a new kind of currency that works differently from traditional money. This currency, called the “Common Good Unit”, would recognize and reward actions that help care for shared resources (like the environment or community), not just individual profit. Instead of every transaction being just about what one person gains and another loses, the new system would also account for impacts on the common good. It would break away from the old zero-sum logic and align personal incentives with the health of everyone and everything we share.

This leads to my foundational questions;

What really drives the resilience of the age-long monetary system? The guest editorial refuses to blame human-nature (selfishness) because everyone acknowledges it in other people but not in themselves, and because there still exist isolated communities without currency.

Are there transformative monetary ideals that have benefited the majority and gained scale within this enduring, age-long monetary system?

In 2019, Michel Bauwens co-authored the book, Peer-to-Peer: The Commons Manifesto, with Vasilis Kostakis and Alex Pazaitis. I thought that would be a good start and perhaps a pointer to other resources. When I wrote to him (Michel Bauwens) about this, he recommended two more books; Bernard Lietaer’s “The Mystery of Money” and David Graeber’s “The First 5000 Years of Debt”, alongside his wiki catalogue on money. This reflection is largely an attempt to answer these foundational questions through these resources.

What really drives the resilience of the age-long monetary system?

Michel Foata-Prestavoine’s refusal to blame human nature in his guest editorial is absorbing. He goes further to call this “foolish and frenzied selfishness of humanity” a “collective myth”, I think not. There is a reason why this system has endured for over 5000 years. If we absorb humans and yield autonomy to the system, that begs the question; “who/what set the system?” After all, the system evolved as humans interacted, not the other way round.

Worthy of note, all consulting authors approached this subject inward-out. Michel Bauwens begins by laying out the Peer-to-Peer system; in which any human being can contribute to the creation and maintenance of a shared resource while benefiting from it. (As an aside, it will be interesting to see the evolution of this system with the rise of autonomous agents and non-human entities.) The other two authors, Bernard Lietaer and David Graeber, approach the subject through the understanding of archetypes & shadows, and through the uncomfortable experience of the moral confusion on money and debt (respectively). The human is a complex entity, and this becomes quickly evident in any attempt to understand the human. Ergo, to understand this foundational question on money, we cannot separate the human-nature from the human.

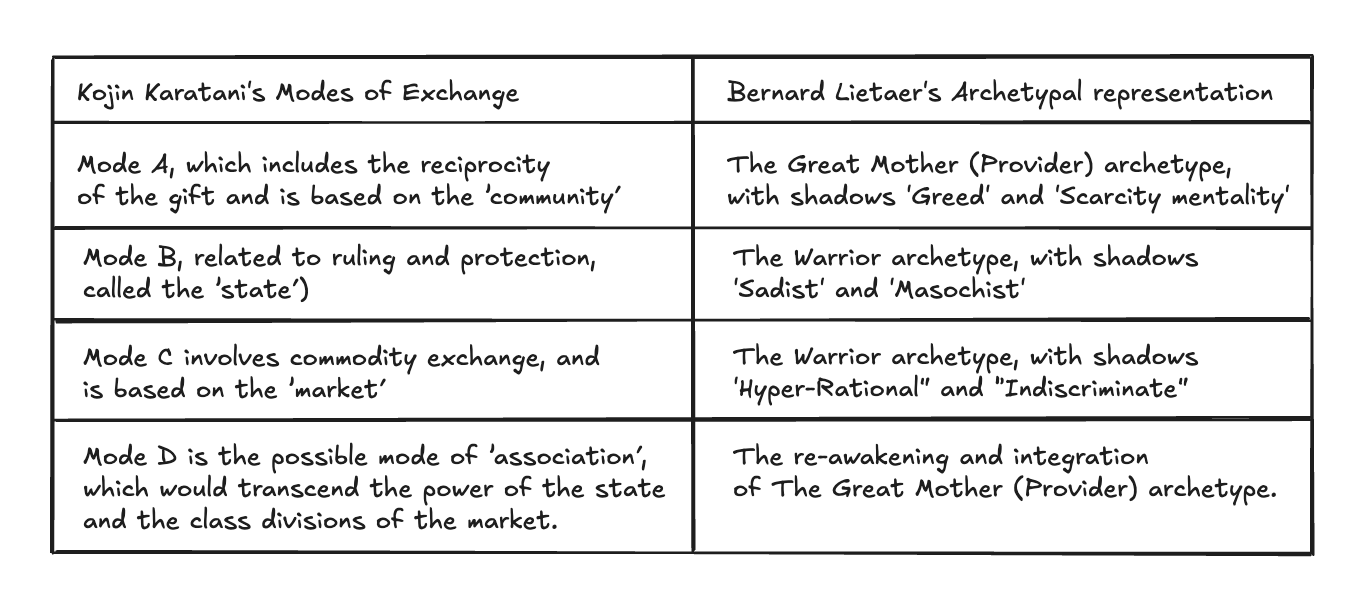

I consider Bernard Lietaer’s exposition on this subject through the language of archetypes very thorough. Archetypes are “recurrent images that patterns human emotions and behavior, and can be observed across time and cultures.” As with all archetypes when repressed, their shadows appear. Bernard frames the recurrent images of money as The Great Mother (Provider/Abundance) archetype in pre-historic times, followed by The Warrior archetype, and The Magician archetype in modern times. The Provider has shadows “Greed” and “Scarcity Mentality”, The Warrior, “Sadist” and “Masochist”, and The Magician, “Hyper-Rational” and “Indiscriminate”.

Indeed, humans have experienced times of, as Michel Bauwens puts it, generative models; whereby the majority (or commons) benefitted from the abundance of The Great Mother, rather than a select few. A time of nurturing where accumulation of resources did not matter. Well, until it apparently did, or so they (prehistoric humans) thought. As societies grew larger and more complex, conquests and invasions grew larger as well. Formal laws and taxation on the conquered developed. Patriarchal structures favouring hierarchy, control, expansion, competition and scarcity became dominant, and slowly, the archetypal Great Mother that built the communities on sharing, stewardship and gifting cultures was repressed. As David Graebar wrote in his “First 5000 Years of Debt”, third world debtor nations are almost exclusively countries that have at one time been attacked and conquered by European countries, often, the very countries to whom they now owe money.

We have grown so accustomed to the shadows of abundance (greed and scarcity mentality) that in 1776, Adam Smith noted that “in all modern societies, the systematic desire for individuals to accumulate is almost universal. Arguing further that greed and fear of scarcity are normal in civilized societies, and you cannot oppose normal behavior.” He would go on to develop Economics, whose purpose would be to allocate scarce resources through the means of individual private accumulation. This repression of the Great Mother archetype has created an imbalance, disconnecting societies from the values of abundance, care, and reciprocity. Lietaer argues that this loss has created emotional and social wounds that persist around money today, and that healing requires restoring balance between masculine and feminine archetypes in our relationship with wealth.

To be clear, when Michel Foata-Prestavoine refers to “isolated communities without currency,” he is not describing societies without exchange, value, or reciprocity, as no such community exists. He is pointing to communities that are anchored to the archetypal Great Mother: gifting, mutual care, reciprocity and stewardship. These societies (which we will get to in a bit) are choosing not to adopt the priced, symmetric and zero-sum transactions that emerged once the Warrior and Magician archetypes became dominant. Their existence does not prove that humans are naturally selfless. Instead, it shows that different archetypal expressions can persist when a culture continually reinforces them. If the dominance of scarcity, accumulation and hyper-rational exchange was created through history and reinforced by conquest, hierarchy and centralization, then rebalancing becomes a historical task as well. Restoring equilibrium between abundance and scarcity, and between nurturance and rationality, will require a collective conscious effort at cultivating the archetypal energies we allowed to be repressed.

Emerging transformative monetary ideals within the enduring system

The Egyptian demurrage currency stands out as an early expression of a transformative monetary ideal designed to benefit the collective. In this system, money steadily lost value over time. People were nudged to invest in the community, support public works, and keep resources circulating, instead of hoarding or seeking individual gain. This logic, which prompted prosperity at the level of the commons, shows how intentional design can reorient monetary systems.

As Bernard Lietaer observed, there has been an upsurge in collective consciousness over the past few decades. The enduring system is being questioned by an expanding subculture who seek new relationships with money and value. It appears that for the first time in centuries, large numbers of people are demonstrating a desire for new currency systems that reflect shared values, mutual care, and stewardship of the commons; a generative model, as opposed to an extractive one.

What Bernard Lietaer captures in archetypal language, Kojin Karatani captures in his “modes of exchange”.

This evolution, as Michel Bauwens describes, is still in seed forms with use-cases such as Enspiral, Sensorica, WikiHouse, and Farm Hack, to mention a few. They show attempts to build new ways of sharing, distributing, and sustaining value collectively. They embody the spirit of Mode D (associationism), constructing value through community and reciprocity, not through classic market accumulation or centralized redistributing authorities. Bernard also suggests that revisiting the Egyptian currency demurrage would be one of the optimal paths forward.

An interesting aspect of this evolution is the technology that makes it scalable, something that wasn’t available in previous generations to accelerate global coordination. Decentralized technologies and currencies allow cosmolocalism to thrive, keeping what is “heavy”, local, and what is “light”, global. While there are still concerns about how these technologies are evolving and the risk of replicating another state-market mode, they have the potential to rebalance our monetary system.

This emergence shows that, although a transformation is ongoing, we do not have the reference to internalize them; and that is precisely why they sound utopian. As Bernard Lietaer puts it, “whenever an archetype is repressed for long in a civilization, that society has not built up any capacity to deal with that aspect of the human psyche.” What we see today is an attempt to widen our reference, with antecedents and with new forms of technology, pointing toward a different relationship with money. Whether these seeds mature into a counter-hegemonic monetary paradigm remains an open question. As Susan Griffin reminds us, “I would like to report that the growth of another way of thinking is inevitable… But there is no foregone conclusion.”

Part II: Selected Quotes on Money

SOME CLASSICS

”That which is for me through the medium of money – that for which I can pay (i.e., which money can buy) – that am I myself, the possessor of the money. The extent of the power of money is the extent of my power. Money’s properties are my – the possessor’s – properties and essential powers. (…). I am ugly, but I can buy for myself the most beautiful of the women. Therefore, I’m not ugly, for the effect of ugliness – its deterrent power – is nullified by money.”

- Karl Marx [17]

Aristotle on unnatural wealth

“There are two sorts of wealth-getting, as I have said; one is a part of household management, the other is retail trade: the former necessary and honorable, while that which consists in exchange is justly censured; for it is unnatural, and a mode by which men gain from one another. The most hated sort, and with the greatest reason, is usury, which makes a gain out of money itself, and not from the natural object of it. For money was intended to be used in exchange, but not to increase at interest. And this term interest, which means the birth of money from money, is applied to the breeding of money because the offspring resembles the parent. Wherefore of all modes of getting wealth this is the most unnatural.”

- Aristotle [26]

TODAY AND TOMORROW

“What we are being asked to reconsider is our perception that money runs the world exclusively. While it is “the one metric to rule them all”, it isn’t actually – and never has been – sufficient for running functioning societies or even markets by itself. Consider the emergence of labels like “organic”, “free-range”, “GMO-free”, “grass-fed”, etc. in recent years. What are these? Through that lens we just introduced, these are nominal currencies, or complementary currencies to money. Clearly, for many people price is not enough to determine whether they want to purchase a good. They rely on other symbols to inform their choices every single day, and so do you.”

- Moritz Bierling [16]

To survive and thrive, human systems *need* a not just a network view, but a multi-dimensional, multi-scaled view and definition of systems. this will help us see how many, many people can operate and multiply many forms of wealth within systems that previously seemed easily depletable. Peer networks are vital to creating the multi-dimensional maps and models and views that will allow all of us to see the cornucopia of options that now exist, provided we can shift out focus from exploitation and control, to existential symbiosis with everything that is around us, on as many scales as possible.

- Sam Rose

“Current attempts to develop new kinds of cryptocurrencies must be judged, valued and rethought on the basis of this simple question as posed by Andrea Fumagalli: Is the currency created not limited solely to being a means of exchange, but can it also affect the entire cycle of money creation – from finance to exchange? Does it allow speculation and hoarding, or does it promote investment in post-capitalist projects and facilitate freedom from exploitation, autonomy of organization etc.?”

- Tiziana Terranova [18]

On Open Money

You treasure what you measure, and you measure what you treasure. Open money provides the tools to implement this maxim. What should we be treasuring in our culture and on our planet that we so far have no way to measure?

- Open Money [20]

Money is making a fundamental evolutionary step into community currencies. Conventional money as we know it has a built in architecture that leads to scarcity, centralization, concentration, secrecy, proprietarization. This conventional monetary system is not appropriate to dealing with today’s global systemic challenges (harmonizing local and global needs, creating ecological sustainability, enabling the information economy, leveraging the open source paradigm, etc). Just as there are now millions of media outlets today, currencies will follow this same evolution by shifting from centralized authoritative models to distributed ones that allow better sustainability, distribution, transparency, and regulation mechanisms.

- Open Money [21]

The Necessary Ecological Function of Money

“If we say that money comes from ecological function instead from extraction, manufacturing buying and selling, then we have a system in which all human efforts go toward restoring, protecting and preserving ecological function. That is what we need to mitigate and adapt to climate change, to ensure food security, to ensure that human civilizations survive. Our monetary system must reflect reality. We could have growth, not from stuff, but growth from more functionality. If we do that and we value that higher than things, we will survive.”

- John D. Liu [23]

Depression Economics

“During periods of so-called economic depression, societies suffer for want of all manner of essential goods, yet investigation almost invariably discloses that there are plenty of goods available. Plenty of coal in the ground, corn in the fields, wool on the sheep. What is missing is not materials but an abstract unit of measurement called ‘money.’

- Tom Robbins [24]

Leakages from the local economy

“Poor liquidity and leakage (money flowing from the local economy) are key causes for floundering and/or disappearing regional economies. To overcome these shortfalls local communities should be increasing local liquidity and plugging the leakage through the introduction of complementary community currencies thereby re-building their respective local communities in the coal mining area of Wales. When local residents within their respective communities changed the agreements they had about conventional money, by creating and spending complementary community currencies locally instead of spending only diminishing amounts of federal currency with giant corporations, it commenced re-birth in the local communities. Molly used the term local multiplier when she discussed how local liquidity increased proportionately to the amount of complementary community currency being circulated by those who were choosing to participate.”

- (from a summary of) Molly Scott reporting on complementary currencies in Wales [25]

The Disintermediation of the Banks

“First, the distribution monopoly of the Postal Services was hit hard by the Net as people discovered they didn’t need to buy stamps. Then, the copyright industry’s distribution monopoly was flatly and unceremoniously run over. As a third and fairly recent victim, we find the old centralized journalism with its tightly controlled news distribution. As fourth and coming victim, there’s an information distribution few people have thought of in terms of information: the money in our society.”

- Rick Falkvinge [27]

On the End of Banking

“There is no reason products and services could not be swapped directly by consumers and producers through a system of direct exchange – essentially a massive barter economy. All it requires is some commonly used unit of account and adequate computing power to make sure all transactions could be settled immediately. People would pay each other electronically, without the payment being routed through anything that we would currently recognize as a bank. Central banks in their present form would no longer exist – nor would money.”

– Mervyn King – Governor of the Bank of England [28]

Will Ruddick on the Strength of Commitment Pooling

‘In both traditional and modern systems, those who control the minting of currency—whether dowry cowries or state money—often accumulate the most wealth. When commitments are centralized into a single form of currency, it not only amplifies inequality but also weakens the entire system’s ability to withstand shocks.

By contrast, commitment pooling as seen in rotating labor associations (ROLAs) offers a more resilient system (you can also create pools on Sarafu.Network) . Instead of relying on a single type of currency or commitment, pooling allows for the direct connection of various types of promises—be it labor, goods, or services. A great natural example of this is mycorrhizal fungi in forest ecosystems. These fungi create networks that connect multiple commitments (nutrients, water) between plants, ensuring that resources flow where needed. The system thrives not because of a single dominant resource but because of the connections between diverse commitments.

This is the key difference between traditional systems that rely on one form of currency and commitment pooling: the latter doesn’t depend on a single medium of exchange. Instead, it acts as a nexus point where multiple commitments are linked, creating a stable, adaptable system that can weather fluctuations or failures in any single type of resource or promise.”

- Will Ruddick [29]

PART III: Towards Post-Capitalist Value Accounting

“Capitals most often represent resource pools that exist in – and hence are borrowed from – The Commons.”

- SustyContextGroup [6]

“There is a way to more equally distribute wealth and transfer value. We can easily build technology to account for, assign, and distribute value as it’s created. Value distribution is coming — it’s just a matter of time.”

- Chelsea Rustrum: [7]

“We are reluctant to cede all econo‐metrics to the Capitalocene. If we are to build post‐capitalist urban resilience, we need tools to track inputs and outputs of money, labour, care, and conviviality. In a moment of transition, in which new metrics are not yet in place, monetized calculation is a way to create “membranes” to capture value from the dominant system, that we can filter and use in a different way.”

- Katherine Gibson et al. [8]

Criteria for Post-Capitalist Value Accounting

We must “unpick the connection between markets, prices, and profit. We want markets, for they are the immediate alternative to both authoritarian decree from above and the black hole of infinite collective deliberation. And we need prices: items registered on a ledger need some quantified units. But we do not want exclusive reference to profits as the motivation or the underlier of units of measure; at least not capitalist-defined profits. (We envision an economy that generates and distributes ‘surpluses’, but we cede the term ‘profit’ to the capitalist lexicon.) A rejection of profits, and prices calculated according to profitability, is a critical condition for thinking value differently: that is, being able to value quantitatively according to the intentional, economically-encoded ethical values of a network. We do not want to focus on the capitalist discourse of ‘externalities’ that trigger state levies and bounties to incorporate social priorities; we want those priorities to be encoded and expressed in the measurement of output value; we want to be able to reveal production for the commons as value creating by its provider, and without the state being that provider (or funder). The key here is how things get ‘recognised’ by the network (that is, reported, accounted for, and calculated), for that determines what gets recorded in the ledger – what constitutes an asset and a liability. A point of emphasis, therefore, is accounting as communication: a transmission of information across the network that both depicts the current state of the network and places each agent within the network view. A different accounting grammar lets you count as the network determines; not as capital determines. This network can produce, attribute value, and reproduce by its own, chosen criteria.”

- Dick Bryan [9]

To Enclose Is To Make Invisible

“The transition from commons to enclosure entails making a world a Terra Nullius, a “no man’s land”. The lifeworlds, the social fabrics, the webs of community made invisible, illegible through the economics of capture. To call out theft not only on a moral but economic level, we have to nurture the networked sense organ which sees planetary state and thus makes its value legible without collapsing it into yet another regime of enclosure. This is a fundamental challenge of legibility. Engaging this challenge begins with bearing witness to the living world we are within. To resist enclosure we must see and attest to a world replete with stories, niches, identities and rituals as anything but empty, or null. To bear witness, is to fundamentally combat the core hypothesis of enclosure which presumes we make productive and profitable what was previously nothing at all, and in so doing counteract willful structural ignorance.”

- Austin Wade Smith [10]

The Axiological Turn Towards Commons-Based Value

“The axiological turn is about giving primacy to the ‘true value’ that emanates from life and nourishes life. The true sources of value are all in commons form. Life itself is a commons, perhaps the most fundamental of them all after the cosmos. Life is a unity emerging out of a web of diversity. It is dynamic and in constant motion, cyclical yet self-enduring and self-flourishing, if its boundaries are not transgressed and if its capacities to thrive are not undermined, especially and ironically in the name of ‘value’!”

- S.A. Hamed and Barry K. Gils [11]

It is measurements that shape our world

“Despite appearances, the majority of our global challenges revolve around measurement infrastructures. For example, the recent economic crisis was largely the result of inadequate and deceptive econometric practices (e.g., the ratings applied to collateralized debt obligations), while the ecological crisis continues to revolve around disputes over, and innovations in, measurement (e.g., calculations of global temperature changes). Measurement infrastructures function to generate (and impose) a shared understanding of the world, and in so doing literally create realities; whether these realities are true, good, and beautiful is another matter. Measures and their related standards also facilitate complexly coordinated social actions and set the terms by which a wide range of evaluative judgments are made, from those about the self (bathroom scale; IQ) to those about whole countries (GDP). Recent decades have brought a rapid proliferation of measurement infrastructures and related forms of standardization, which impact the most intimate details of our lives and the most significant planetary initiatives. A metatheoretical approach is needed that can expose the false realities created by inadequate and oppressive measurement practices as well as inform the creation of new approaches to the representation of complex global realities.”

- Zachary Stein [12]

“Measurements, including practices such as zooming in or examining something with a probe, don’t just happen (in the abstract) they require specific measurement apparatuses. Measurements are agential practices, which are not simply revelatory but performative: they help constitute and are a constitutive part of what is being measured. In other words, measurements are intra-actions (not interactions): the agencies of observation are inseparable from that which is observed. Measurements are world-making: matter and meaning do not preexist, but rather are co-constituted via measurement intra-actions.”

- Karen Barad, The measure of Nothingness) [13]

What we need to measure first of all: Carrying Capacity

From James Quilligan on Carrying Capacity as a Basis for Political and Economic Self-Governance:

1.

“No major civilization has EVER practiced carrying capacity as a basis for political and economic self-governance; carrying capacity has only succeeded in small communities. Of course, we know this from the modern Ostrom view of the commons; but Ostrom never put her finger on the pulse of carrying capacity as the *self-organizing principle between a species and its environment*. Nor has the commons movement recognized the importance of an *empirical way of measuring the metabolism of society* through the cooperative activities of people using resources to meet their biological needs. In other words, Ostrom and the commons movement have yet to define the dynamic equilibrium which they seek as the balance between two opposing forces - population and resources - which continually counteract each other. Instead, the commons movement is more focused on counteracting the Market and the State than on measuring the replenishment of renewable and non-renewable resources and managing them to sustain their yield. In short, the commons movement does not seem to be producing alternative indicators for the productive and provisioning which can be used to guide policy. ... (We must) ... establish empirical targets that will bring down exponential growth to arithmetic growth levels; and thus organize society according to the dynamic equilibrium between population and the availability of food, water and energy. ... If we don’t know how to develop evidence-based policy for a soft landing toward a reasonable level of subsistence -- and I’ve seen very little of this in the commons movement -- then I don’t know how we expect to create a long-term system for meeting human needs through sustainable yields. I would hope that the commons movement begins to create the basis for a viable new society by actually focusing on the optimum rate at which a resource can be harvested or used without damaging its ability to replenish itself.”

- James Quilligan, Fb, August 2017

2.

“Just as the US took the world off the gold standard and the world went from fixed to floating exchange rates, the Limits to Growth report was published. No one realized at the time that the planetary limits of non-renewable resources which were only then beginning to be identified by mainframe computers would now have have no possible direct bearing on a money supply backed by fixed reserve assets under the new regime, because the international monetary system was now deregulated (which kicked off the era of neo-liberalism, the supplanting of monetary policy by finance and a complete political denial of planetary limits). This shift in monetary policy expressed, in true post-modern fashion, that “all values are relative”, systemically delinking the world’s socio-economic institutions from the natural world and encouraging the massive consumer credit rampage for the fire sale of the world’s resources since then. It is time now to establish a structural link between planetary limits and monetary value which supplants price signals with monetary signals, in order that currency value directly expresses the carrying capacity between the available non-renewable resources and the needs of an ever-increasing population. In short, today’s free-floating currency value must become fixed once again, this time with an entirely new anchor: non-renewables, probably including gold.“ (https://www.facebook.com/groups/322508360006/permalink/10159755244420007/?)

GDP is Sexist: The value of non-market household work

“When the GDP was developed in the early 20th century, caregiving and raising children were considered women’s work, not worthy of inclusion in the metrics comprising the score. As Riane Eisler, president of the Center for Partnership Studies and author of The Real Wealth of Nations: Creating a Caring Economics, notes, “Studies show that if caregiving work were included, it would constitute between 30% and 50% of the reported GDP.”

This “household” or “nonmarket” product—which beyond caregiving activities includes cooking, gardening, and housework according to a 2012 report—is not only economically significant but, if measured, could improve women’s lives (or the men who do equivalent tasks). Were the GDP to be updated in 2018 to recognize that women globally provide these essential undervalued services, metrics would likely change to better incorporate the fundamental activities that underpin traditional economic measures. As the report states in its findings, “Home production reduces measured income in equality.”

But society has chosen not to update this outdated metric. And as a result, the GDP is sexist. Plain and simple. It’s time to upgrade the system to galvanize “household production”—and the women who provide the majority of it—as something worthy of measure.”

- John C. Havens: [14]

On the Value Revolution that is taking place

“Under the radar of mass media and mainstream academia, a value revolution is taking place that is promising to transform humanity’s very notions of wealth and economic development. Expressed in an explosion of both traditional academic indicators and innovative new quality-of-life and sustainability measures, this value revolution is not simply revealing previously invisible “full costs” of production, but also “redefining progress” more positively—from quantity to quality. Economically, our ways of growing and distributing food, providing & using energy, building buildings, making and exchanging clothing, etc. are being reexamined not only to reduce their negative impacts, but also to more fully express their social and ecological potentials. They are geared not simply to the sustainability of communities and ecosystems, but to their regeneration—to make economic development, as eco-architect Bill McDonough would say, “not just less bad, but good.”

- Brian Milani [15]

On Measurement and Power

“The history of measurement has been a history in which the privileged and empowered have been the creators and institutionalizers, while the oppressed and powerless have had no choice but to use their master’s tools and definitions of reality (Kula, 1986; Scott, 1998). This is a pattern that continues to this day, perhaps best exemplified by current trends in educational “reform,” where in the United States, billionaires who never set foot in a public school growing up, and who send their own children to private schools, swayed federal legislation toward the creation of a vast technologically intensive testing infrastructures that now dominates the entire public school system (Ravitch, 2014). New tests and measures are being forced upon teachers; if they do not use them they can be fired. Educators are being disempowered, deskilled, and rendered without voice when it comes to some of the most essential aspect of their professional practice, i.e., assessment drives curriculum and pedagogy. Meanwhile for-profit industries are poised to make billions off the privatization of one of the oldest and most inspiring public institutions in American history.”

- Zachary Stein [16]

Tiberius Brastaviceanu on Open Value Accounting Systems

“We need to make the distinction between co-creation of value and value exchange. These are two important processes but very distinct ones. Sensoricans are working hard to solve the value accounting problem, which is meant to support large scale co-creation of value. The value accounting is a way to capture individual contributions that blend into a unique product, to evaluate these contributions, and to compute equity in the end product, a % for every member.

NOTE the value accounting system is NOT a system that objectifies value and it is not a bean counting system! It is a contract, a method to which all contributors adhere to reassure every contributor about how the future revenue will be redistributed. That’s it! It preserves the subjective nature of value, it can take, in theory, into consideration all types of value, tangible and intangible.

Once the product is made it is exchanged, and this is where you need currencies, or systems of value exchange.

Again, value accounting for co-creation of value and value exchange are two different things in my mind. These two systems must interact with each other, but we need to see them as separate. One is designed to manage the amalgamation of value from different agents into one product, the other one is designed to facilitate value exchange between different agents, with no value added in the process.”

Tom Walker on the need for a new Social Accounting system for the Labor Commons

“What I proposed in “Time on the Ledger” is a social accounting framework for evaluating the net social productivity of different hours of work arrangements. The basic idea is that first, there are fixed social cost to labor that are not reflected in capitalist accounting and the way that employers can shed their labor costs by laying off workers and second, there is a technologically-determined optimal length of working time per worker exceeding which subtracts from net social product over the longer period. The information from this process can guide collective bargaining and public policy advocacy while at the same time inculcating a commons mentality in practitioners. It is not enough to translate back and forth between capitalist accounting perspective and a commons ideal. One must become fluent in a new social accounting language.” (http://ecologicalheadstand.blogspot.ca/2013/02/the-new-charter-of-industrial-freedom.html)

What the token economy can do for accounting value

“Innovation of measurement in the crypto economy may actually hold the key to the measurement problems in the more established capital markets. The problem in the conventional markets is that they are being asked to measure things that don’t readily fit into the conventional accounting categories. But the crypto economy is not shackled by those conventional categories, and so can develop the devices to ‘measure the unmeasurable’. ... Could we think of a thresholding, a binding, an accounting system — a token valuation system — in which organizations operating within ECSA (the so called “economic spaces”, our version of 21st century modes of economic association) nominate the performance criteria by which they want their assets and output to be valued: ways that will specifically address the contributions of intangible capital and immaterial labour, so that social contribution can be recorded in ways that best befit those contributions?” “

- Dick Bryan [17]

Natural Capital

“‘For the management of renewable resources there are two obvious principles of sustainable development. First, harvest rates should equal regeneration rates (sustained yields). Second that waste emission rates should equal the natural assimilative capacities of the ecosystems into which the wastes are emitted. Regenerative and assimilative capacities must be treated as natural capital, and failure to maintain these capacities must be treated as capital consumption, and therefore not sustainable.’”

- Mathis Wackernagel [18]

From Kojin Karatani:

"In his youth, Marx discussed money, quoting Shakespeare’s “Timon

of Athens” as follows.

Shakespeare stresses especially two properties of money:

1. It is the visible divinity – the transformation of all human and

natural properties into their contraries, the universal confounding and

distorting of things: impossibilities are soldered together by it.

2. It is the common whore, the common procurer of people and

nations.

The distorting and confounding of all human and natural qualities,

the fraternization of impossibilities – the divine power of money – lies in

its character as men’s estranged, alienating and self-disposing species

nature. Money is the alienated ability of mankind.

This is clearly Marx’s application of the Feuerbachian critique of

religion to money. And just as Feuerbach’s materialist inversion of Hegel

remained within the framework of Hegel’s thought, Marx also remained

here within the framework of classical economics, even as he criticized it

with great fanfare.

However, Marx in Capital is different. There were quite a few

thinkers who pondered the riddle of money. But Marx was the first to

trace it to the commodity, which appears so “obvious” and “trivial” that

nobody had really paid attention to it. “A commodity appears at first sight

an extremely obvious, trivial thing. But its analysis brings out that it is a

very strange thing, abounding in metaphysical subtleties and theological

niceties” (Capital 1, p163).

A commodity is not a mere object. It is a form that a thing takes

when exchanged. The thing is a “sensuous matter,” but “as soon as

it changes into commodity, it changes into a thing which transcends

sensuousness.” Something like a spirit attaches to the thing. “I call this

the fetishism which attaches itself to the products of labor as soon as

they are produced as commodities, and is therefore inseparable from the

production of commodities.”( p165). “The riddle of the money fetish is the

riddle of the commodity fetish, now become visible and dazzling to our

eyes” (p187)."

- Kojin Karatani, Capital as Spirit

https://www.crisiscritique.org/storage/app/media/2016-11-16/kojin-karatani.pdf

Thank you for such deep work, Michel! Honored to see my reflections woven into a much larger fabric of how we are rethinking this! ❤️